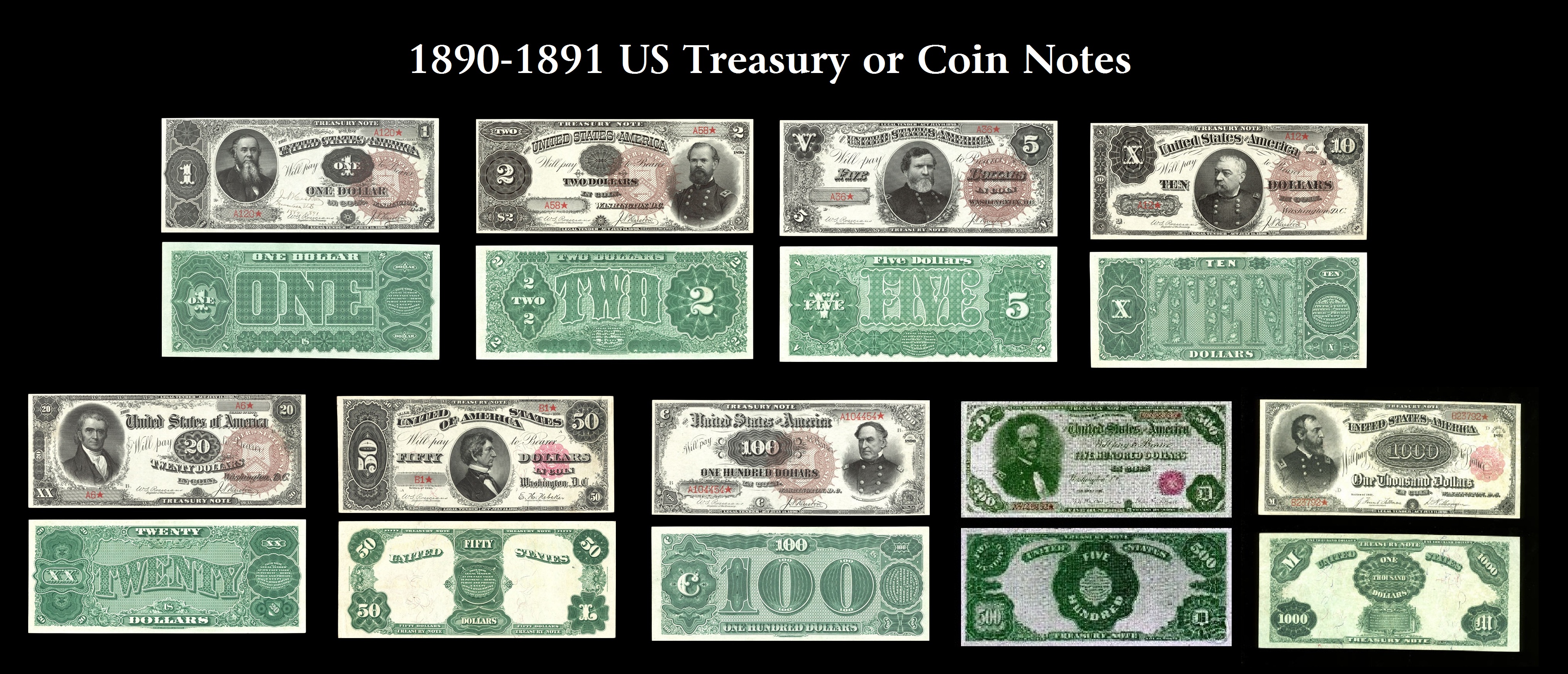

It does not prohibit Congress from emitting such bills, but it does not authorize Congress to do so either. The Constitution explicitly forbids the states to emit bills of credit. Sherman remarked that the moment was opportune "for crushing paper money." Nathaniel Ghorum opposed the motion because "an absolute prohibition of paper money would rouse the most desperate opposition from its partizans." It is clear from these statements (as well as several others) that the Framers considered paper money a type of bill of credit, as distinguished from coin. However, Roger Sherman made a motion to prevent the states from emitting bills of credit as well. The clause quoted in the preceding paragraph originally prohibited states from coining money, but not from emitting bills of credit. coin Money emit Bills of Credit."įiat money, or paper money, is an example of a bill of credit. Article I, Section 10, Clause 1 provides, "No State shall. The fact that the Framers distinguished between coin and bills of credit is quite clear from the text alone. Coin derives its value from the metal of which it is made, but a bill of credit it derives its value entirely from faith in the government of the United States. 330 (1935).There is a distinction between the coining of money and the emission of bills of credit. Similarly, the Supreme Court also upheld Congress’s abrogation of clauses in pre-existing private contracts allowing bondholders to elect to be paid in foreign currencies. Jump to essay-8 Legal Tender Cases (Knox v.Jump to essay-7 Legal Tender Cases (Knox v.The Court reasoned that such abrogation would render obligations of the United States, entered into by earlier Congresses pursuant to their authority to borrow money on the credit of the United States, mere illusory pledges. However, as to obligations of the United States (as opposed to those of private parties), the Supreme Court has held that such an abrogation was an unconstitutional use of the coinage power. The Supreme Court also upheld Congress’s authority to abrogate clauses in pre-existing private contracts calling for payment in gold coin. The Supreme Court denied recovery to a plaintiff who sought payment for gold coin and certificates thus surrendered in an amount measured by the higher market value of gold on the ground that the plaintiff had not proved that he would suffer any actual loss by being compelled to accept an equivalent amount of other currency. Consistent with this power, Congress may require holders of gold coin or gold certificates to surrender them in exchange for other currency not redeemable in gold. The Supreme Court has also held that the power to coin money imports authority to maintain such coinage as a medium of exchange at home, and to forbid its diversion to other uses by defacement, melting, or exportation. the Supreme Court sustained the power of Congress to make Treasury notes legal tender in satisfaction of antecedent debts. Inasmuch as every contract for the payment of money, simply, is necessarily subject to the constitutional power of the government over the currency, whatever that power may be, and the obligation of the parties is, therefore, assumed with reference to that power, 7 Footnote

To this end, it may impose a prohibitive tax upon the circulation of notes of state banks 5 Footnote and it may restrain the circulation of notes not issued under its own authority. Congress may charter banks and endow them with the right to issue circulating notes, 3 Footnote The Supreme Court has also construed Congress’s power to coin money and regulate the value thereof to authorize Congress to regulate every phase of currency. the Supreme Court has recognized Congress’s coinage power to be exclusive.

īecause Article I, Section 10, Clause 1 of the Constitution prohibits the states from coining money, 1 Footnote To coin Money, regulate the Value thereof, and of foreign Coin, and fix the Standard of Weights and Measures.

0 kommentar(er)

0 kommentar(er)